My Site Title

Multidisciplinary Valuation and Corporate Advisory Firm Transparently Serving the Full Range of Attorneys, Asset Managers, CFOs, and CPAs TM

Multidisciplinary Valuation and Corporate Advisory Firm Transparently Serving the Full Range of Attorneys, Asset Managers, CFOs, and CPAs TM

Alternative Investment Valuation and Financial Advisory Firm Transparently Serving the Full Range of Asset Managers, Attorneys, CFOs, and CPAsTM

NAV's portfolio valuation practice delivers a leading, diversified experience across all assets and investment funds. ASC 820, Fair Value Measurements, serves as the leading authoritative guidance within U.S. GAAP accounting for the valuation of portfolios.

We have valued fund portfolios not just for financial reporting but also within the real-world context of M&A. The latter is a key distinction as many portfolio valuation specialists lack any semblance of actual experience as an M&A advisor for funds seeking to acquire, divest, or issue securities. The intricacy of portfolio valuation accordingly is well-suited for our firmwide multidisciplinary expertise.

NAV's team specializes in providing a true, full-service range of portfolio valuations. Whether valuing the complete portfolio of investments or certain components, we understand the importance of fund valuation credibility and authoritative documentation and support.

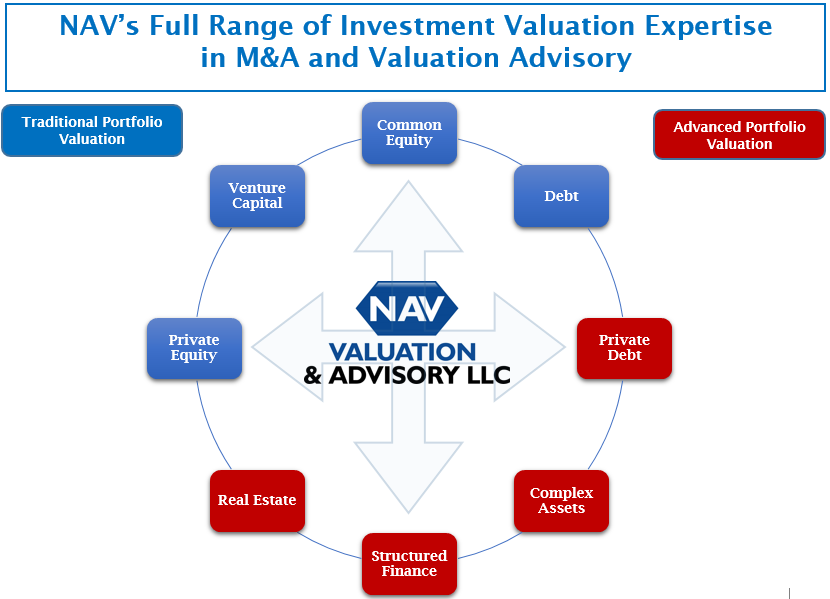

We have served leading alternative investment funds, business development companies, early-stage vehicles, family offices, fund administrators, endowments, and public / private companies in their portfolio valuation needs. We have valued both traditional and complex assets for our clients' portfolios.

Our portfolio valuation services entail a deep record and expertise in both traditional and advanced investment categories.

We work on a flat-fee or hourly basis with leading attorneys, alternative investment funds, CFOs, CPAs, and other C-suite corporate executives.

We strongly feel engagement scope and fee ranges should be communicated effectively and efficiently. We accordingly perform our work in stages, and we encourage clients to take a methodical, calculated approach to deciding which service offerings are necessary versus desired.

The first stage is dubbed the NAV Situation Scan (TM). The Situation Scan helps both our clients and our teams diagnose the services necessary for fulfilment of client objectives. We then communicate the results of the Situation Scan to derive a suggested road-map. The NAV team next proposes a time frame for delivery of service milestones. We are inherently flexible, and our Situation Scans outline a proposed plan of action and not a mandatory obligation. We have found clients cherish this "ramp-up or ramp-down" flexibility that can be implemented at any time.