My Site Title

Multidisciplinary Valuation and Corporate Advisory Firm Transparently Serving the Full Range of Attorneys, Asset Managers, CFOs, and CPAs TM

Multidisciplinary Valuation and Corporate Advisory Firm Transparently Serving the Full Range of Attorneys, Asset Managers, CFOs, and CPAs TM

Alternative Investment Valuation and Financial Advisory Firm Transparently Serving the Full Range of Asset Managers, Attorneys, CFOs, and CPAsTM

NAV's M&A Due-Diligence practice delivers a leading, diversified experience that blends and maximizes our multidisciplinary expertise across accounting, valuation, and M&A corporate finance. We look "beyond the numbers" of traditional accounting due-diligence in advising our corporate and fund clients on all aspects of company performance, outlook, and valuation.

In addition, we have valued and reviewed hundreds of real estate properties in the last ten years. Our valuation background is therefore highly-developed across property types and locations.

NAV's 150-plus M&A transactional record provides the foundational support for our ability to analyze a deal from the vantage points of an M&A investment banker, CPA due-diligence consultant, or valuation expert.

Furthermore, we have led and executed 25-plus real estate M&A transactions and financings in recent years, a clear signal of our real estate record and marketplace expertise.

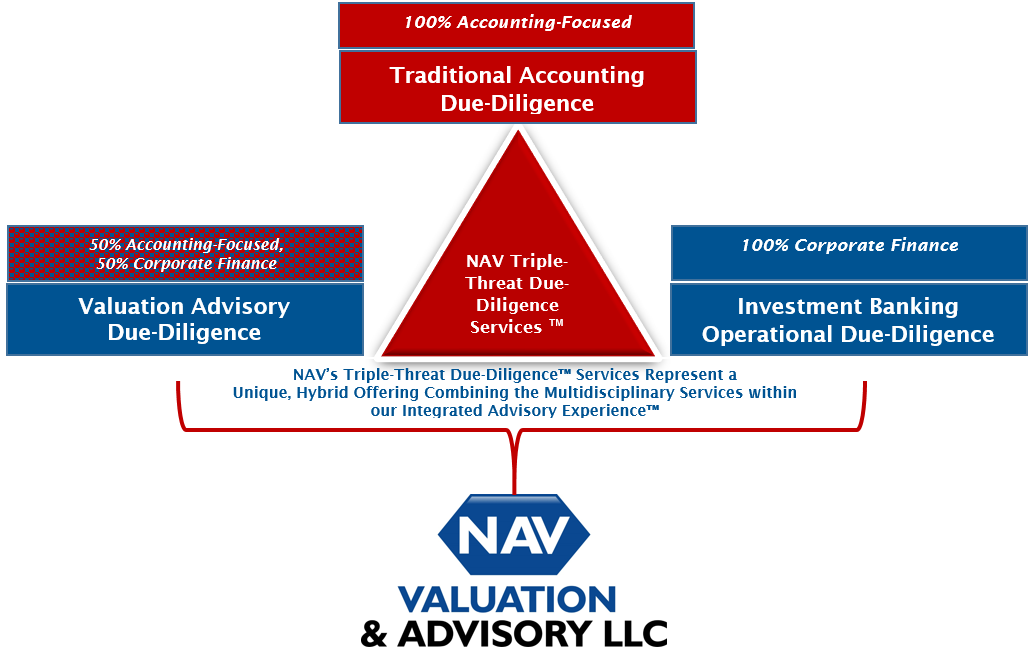

We leverage our diversified financial advisory services to provide this industry-unique, "triple-threat" due-diligence service. The following chart captures our NAV dynamic:

NAV's team delivers due-diligence findings and detailed valuation reports to help clients analyze the possible strengths, weaknesses, opportunities, and threats of a proposed acquisition. We next confer with all parties to communicate the deal's time frame and risks.

Finally, our team helps establish milestones and time frames that coordinate with the goals of corporate and legal advisors. This ensures effective and constant communication during the fast-paced nature of due-diligence advisory.

We perform our services on a flat-fee or hourly basis with leading attorneys, alternative investment funds, CFOs, CPAs, and other C-suite corporate executives. We strongly feel engagement scope and fee ranges should be communicated effectively and efficiently.

We accordingly serve clients in stages, and we encourage clients to take a methodical, calculated approach to deciding which professional offerings are necessary or optional.

Our first service stage is dubbed the NAV Situation Scan (TM). The Situation Scan helps both our clients and our teams diagnose the services necessary for fulfilment of client objectives. We then communicate the results of the Situation Scan to derive a suggested road-map. The NAV team next proposes a time frame for delivery of service milestones. We are inherently flexible, and our Situation Scans outline a proposed plan of action and not a mandatory obligation. We have found clients cherish this "ramp-up or ramp-down" flexibility that can be implemented at any time.